Preamble

Market study on the renewable energy trends in France. It includes the topics of:

- Global energy trends

- French energy production

- Changes of environmental policy in France

- Innovation and technology

- PV solar energy and self-consumption

- Financing and investment

- Presentation of Mirova, Enercoop and Énergie Partagée

This report has been prepared in Mai and June 2017 by Eléonore Bouchet and updated in June 2018.

Renewable Energy: Sectors

Solar Energy

Photovoltaic

Thermal

- Greenhouses

- Solar collectors

Wind Energy

Wind

Hydropower

Hydropower

- Small hydroelectric plant

- Large hydroelectric plant

- Marine (wave, tidal, ocean)

Biomass

Firewood

Biogas

- Biogas plant, biodigester

Biofuel

- Distillery, esterification unit

Geothermal

Geothermal

- Heat pumps (<30°C)

- Low and medium energy plant (130°C - 150°C)

- High energy plant (>150°C)

- Plants on fractured hot rocks

Introduction: Global Trends

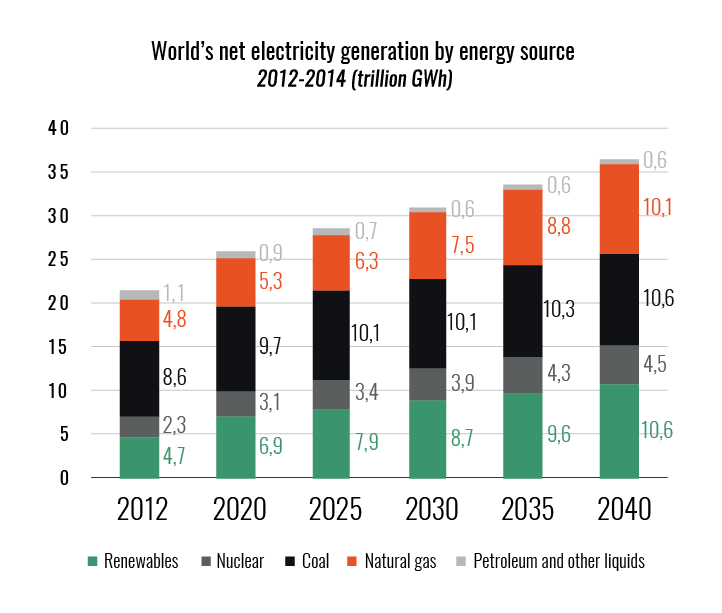

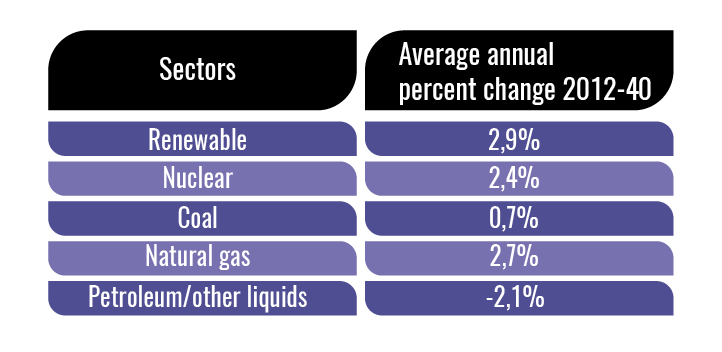

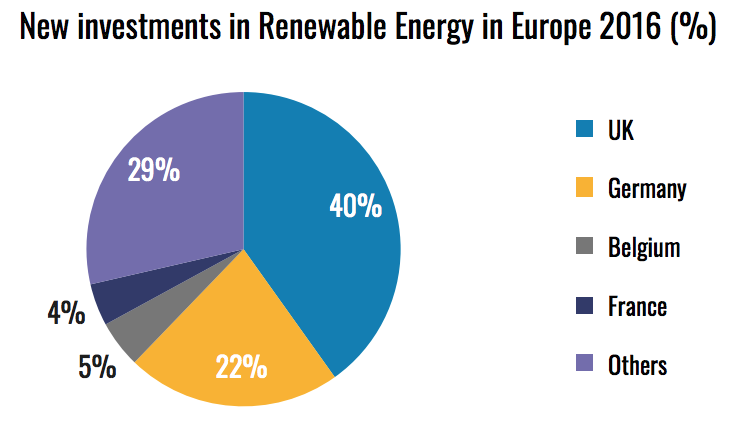

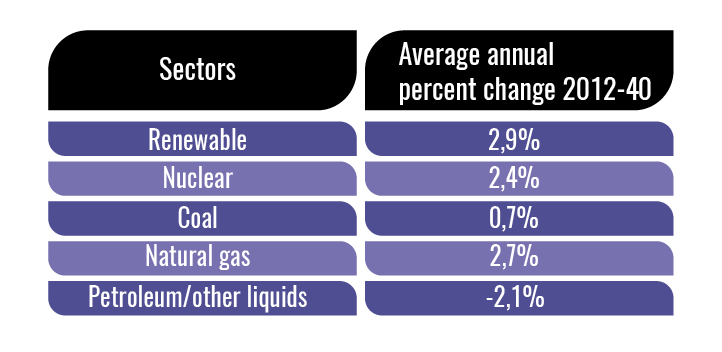

World’s electricity generating mix: 2012-2040 evolutions

Sources: US Energy Information Administration, International Energy Outlook 2016, chapter 5 “Electricity”

Coal

Coal continues to be the largest single fuel until the end of the projection period in the IEO2016 Reference case. It accounted for 40% of the total world electricity generation in 2012. Despite a continued increase in value, it declines to 29% of the total coal-fired electricity generation. On average, coal consumption for electricity grows by 0,7% per year from 2012 to 2040.

Natural Gas

Natural gas consumption for electricity grows by an average of 2,7% per year from 2012 to 2040. From 22% of the total world electricity generation in 2012, the natural gas share increase to 28% in 2040.

Petroleum and other liquid fuels

The use of petroleum and other liquid fuels falls from 5% in 2012 to 2% in 2040, with an average annual decline of 2,2%. Despite their recent decline, oil prices are expected to be higher on the long-term. As a result liquids remain a more expensive option compared to other fuels used for electricity generation.

Nuclear power

Nuclear electricity generation increases from 2,3 trillion kWh in 2012 to 4,5 trillion kWh in 2040. The growing limits on gas emissions encourages the development of nuclear capacity. Underlying the nuclear projections:

- Security issues raised especially after Fukushima disaster.

- Retirements of nuclear power plants planned in Europe countries

- Strong growth of nuclear power capacity in non OECDAsia (especially China and India)

Renewable resources

Renewables are the fastest growing source of electricity generation: total generation from renewable resources increases by 2,9% per year as the renewable share of world electricity generation grows from 22% in 2012 to 29% in 2040. Renewable generation overtakes coal to become the world’s largest source of energy for electricity generation by 2040.

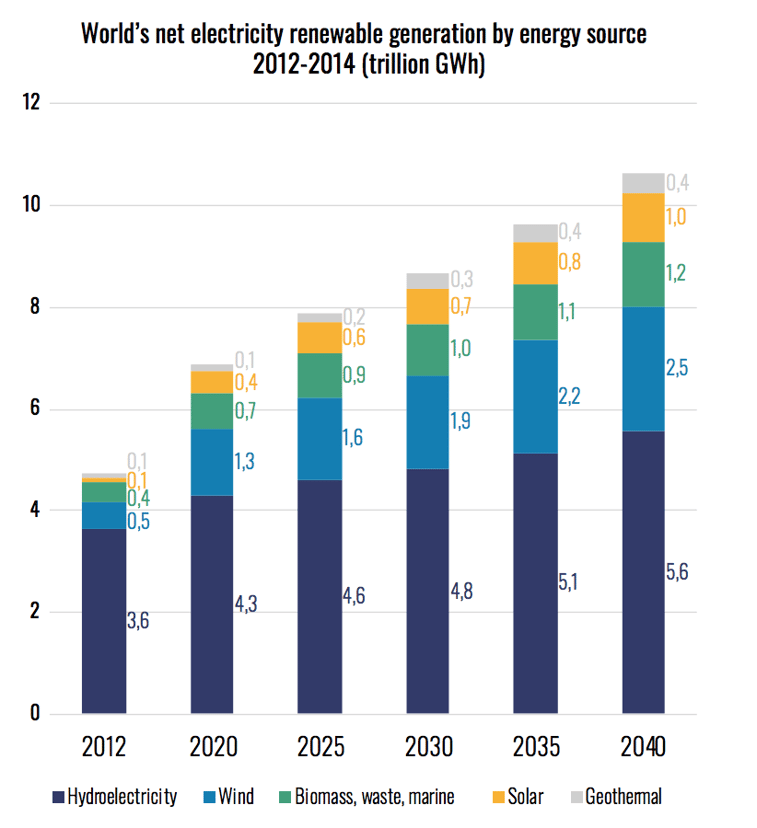

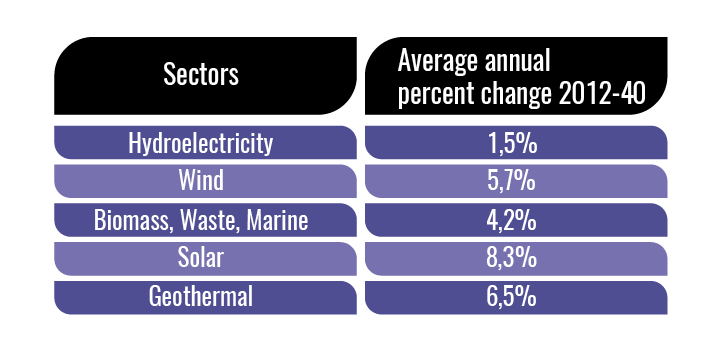

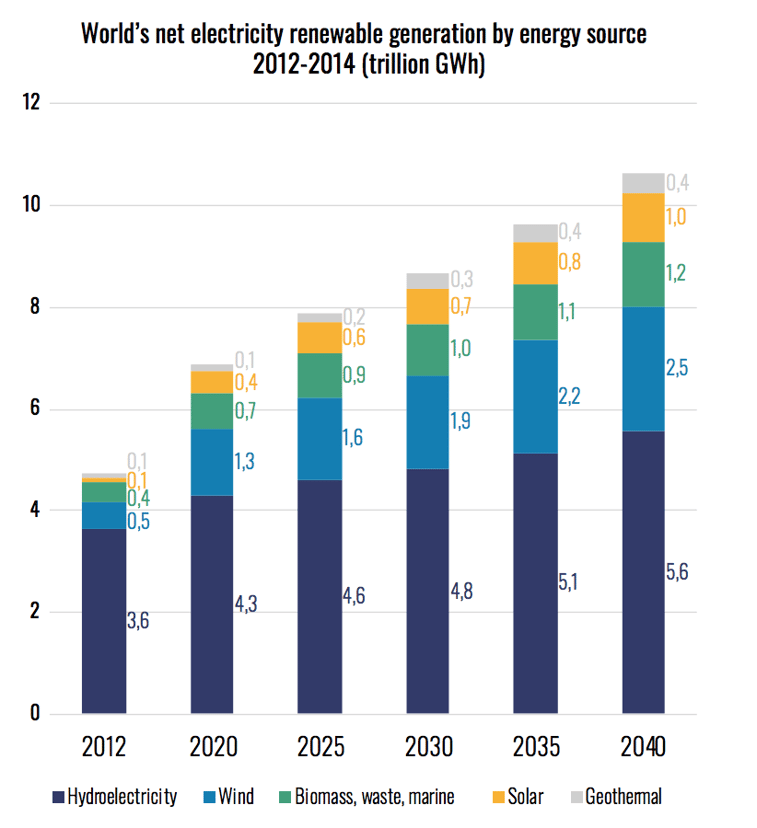

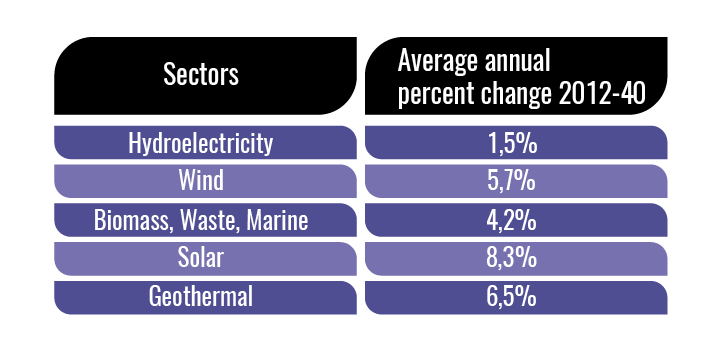

World’s renewable electricity generating mix: evolution

Generation from non hydropower renewables is the predominant source of the increase of renewables share of the world’s total supply (5,7%/year). It outpaces the increases in natural gas (2,7%/ year), nuclear (2,4%/year) and coal (0,7%/year).

Non-OECD hydropower generation increases by 71% from 2012 to 2040. Hydropower development potential is much lower in OECD countries as in the non-OECD countries because most of the OECD potential hydroelectric resources already have been developed. Instead, the greatest potential for growth in renewable energy generation in the OECD countries is from non hydroelectric resources.

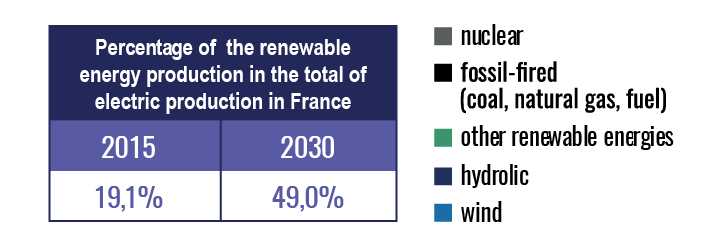

French Energy Production

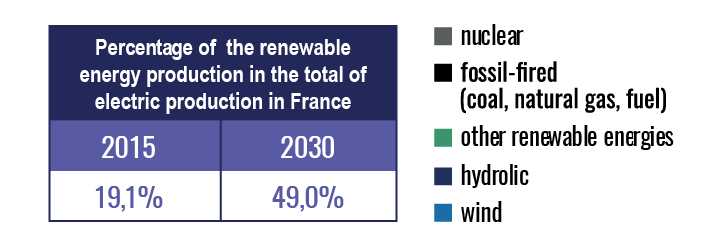

Electricity generation in France: sectors and evolution

Sources: Ademe, “Ademe Énergie 2030 : Production d’énergies renouvelables”

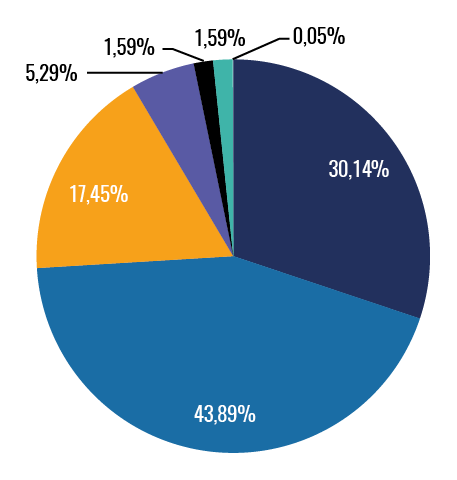

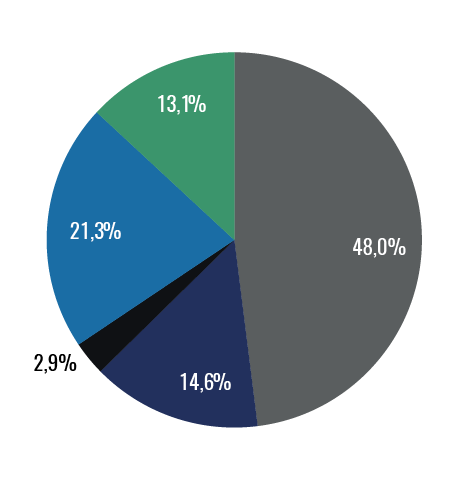

Part of the electric production in France in 2015 (%)

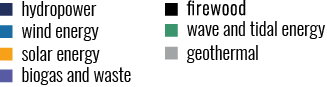

Part of the electric production in France in 2030 (%) Prospective by ADEME in 2012

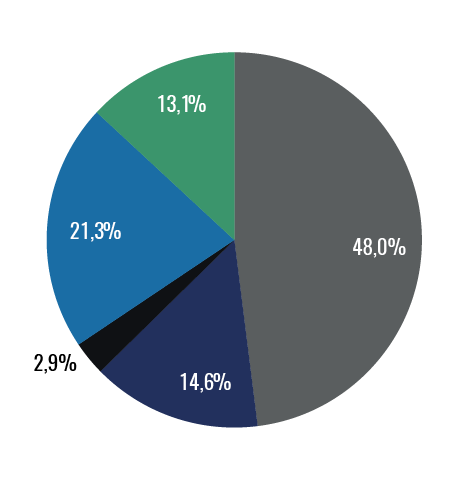

Renewable electricity generation in France: sectors and evolution

Sources: Observ‘ER, “Le baromètre 2016 des énergies renouvelables électriques en France” Ademe, “Ademe Energie 2030 : Production d’énergies renouvelables”

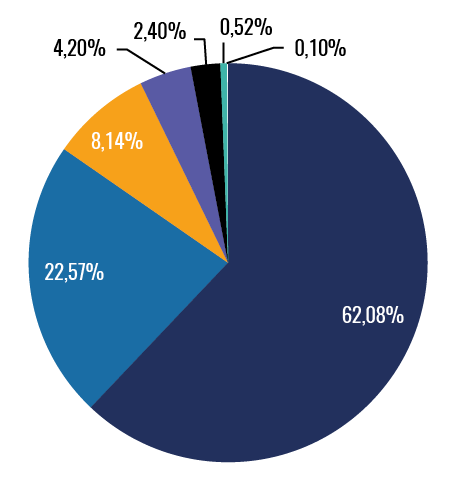

Renewable Energy Electric Production in France in 2015 (%)

Renewable Energy Electric Production in France in 2030 (%) Prospective by ADEME in 2012

Changes in Public Policy in France

President Macron´s environmental policy

The president Emmanuel Macron plans to take action and invest in alternative renewable energy sources. With the environmental activist, Nicolas Hulot as Minister of Ecological and Solidarity Transition, the government will follow the previous commitments in favour of the energy transition.

CONTINUITY

The French president Emmanuel Macron program is in line with the Paris agreements at international level and with the law “Energy Transition for Green Growth“ and the biodiversity law.

“EN MARCHE“: THE ENVIRONMENTAL PROGRAM

On 50 billion public investments planned by the government, 15 billions will be dedicated to the energy and ecological transition.

Objectives

Significant reduction of fossil fuels

- Closure of coal-based power plants in 5 years.

- Ban on shale gas explorations and no new license for hydrocarbons explorations delivered.

- Integration of the ecological cost in the price of carbon by increasing the carbon tax (to reach €100/tCO2 in 2030).

Accelerate the changes toward well-balanced energy production, carbon free

- Objective of 32% of renewable energy in 2030 (energy transition law).

- Objective of 50% of nuclear energy in 2025.

- RE financing: objective to doubling the wind and photovoltaic energy capacity by 2022.

- Favour private investment: shorten and simplify the procedures for RE deployment.

- Focus on research, development and investment efforts on storage operators and smart grids

Circular economy and recycling: a new economic model

- Divide by two the dumped household waste by 2025

Support the transitions

- Attributions of funds to the regions in return of their commitment to reduce their environmental footprint (by the production of local RE), to protect biodiversity and to create jobs

Objectives

The Energy Transition law sets the main objectives of a new French energy model. It aims to encourage green growth by reducing the French energy invoice and by favouring renewable energy.

Sources:

- Connaissance des Energies (CDE), “Loi de transition énergétique: les députés adoptent le texte définitif”

- Ministère de la transition écologique et solidaire, “Loi de transition énergétique pour la croissance verte”

Increase the use of Renewable Energy

- Possibility for citizens and local authorities to receive funding for renewable energy projects.

- Widespread use of the single permit for wind energy, biogas and hydroelectricity.

- Obligatory power purchase rates will finance self-generated renewable electricity consumed by private individuals and businesses: a call for projects for commercial and industrial buildings will be launched before summer.

- Objective of financing 1 500 methanation projects in France

Smart Grid

- 35 million Linky smart meters (electricity)

Multiannual Energy Plan (MEP): objectives 2023

Planned by the energy transition law, the MEP sets the general orientations of the energy policy in France (oct. 2016).

Renewable Electricity

The total of quantitative objectives of development in renewable electricity enables to reach a renewable energy production between 150 and 167 TWh a year in 2023.

Hydropower

The MEP expects no development, except the replacement of former hydraulic utilities.

Onshore Wind

The objectives are coherent with the French potential. To reach these objectives, the growth has to be 1,5-2,2GW a year.

Offshore Wind

Between 500 and 6000 MW more of started projects, according to the concentrations of the convenient zones, the feedback of the launched of the firsts projects and prices. However, delays already were announced for the firsts offshore wind plants.

PV Solar

The objectives are ambitious and the legal framework evolved in the right direction.

Methanation, waste, biogas

The objective is not really ambitious and should be reach.

Firewood

The objective is very uncertain. It will depend on the success of calls for tender (CRE) and on the improvement of the current incineration utilities.

Marine

Between 200 and 2000 MW more of started projects, according to the feedback of the pilot farms and the prices conditions.

Geothermal

Objectives are reachable considering the currently started projects.

Solar Thermal

No objectives are planned in the MEP.

Photovoltaic Solar Energy (and self-consumption)

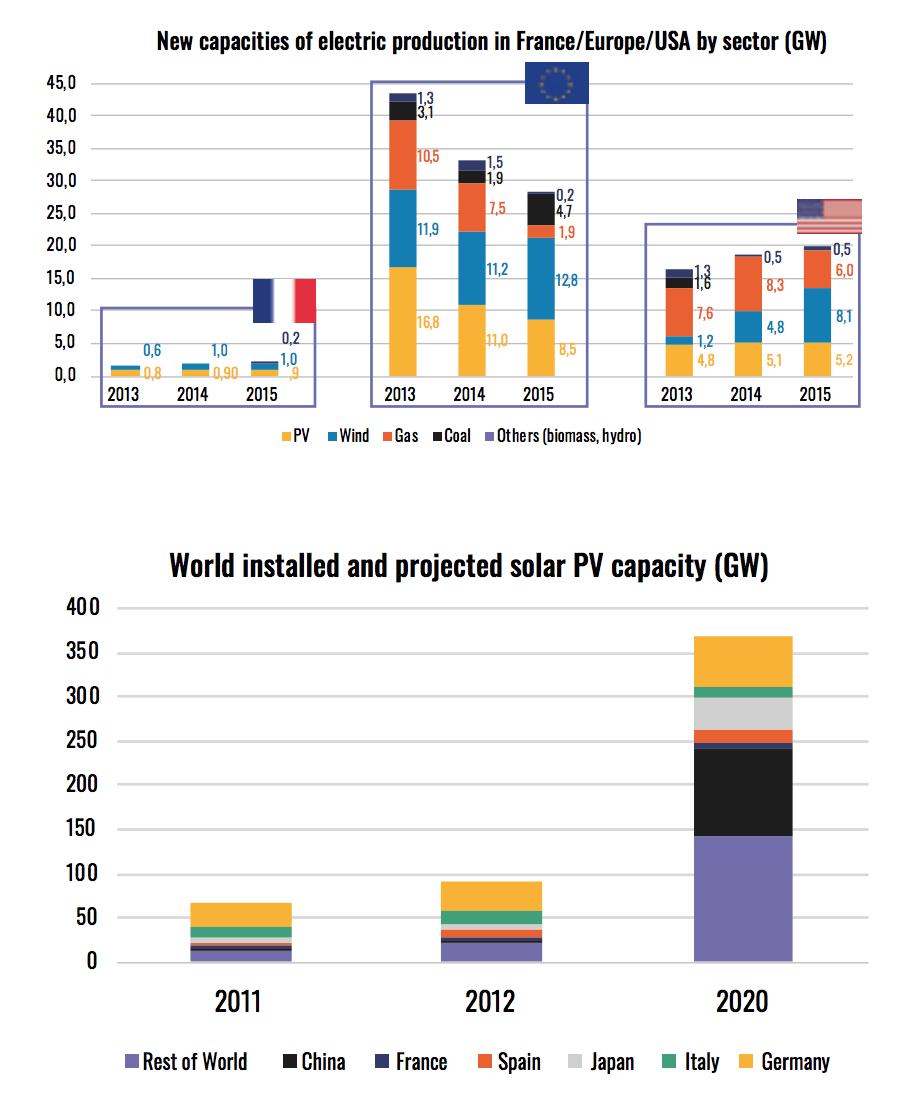

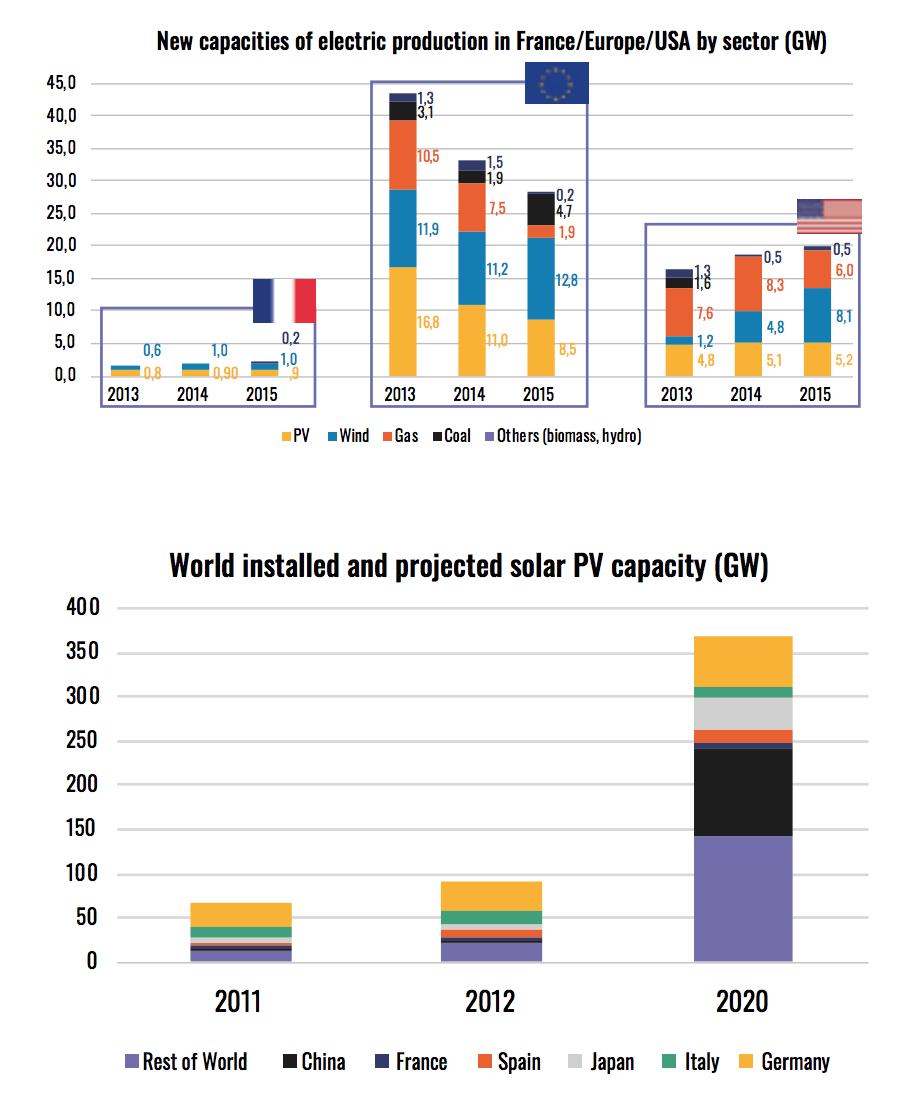

Photovoltaic Solar Energy:World and Europe

World's trends

PV manufacturing companies have been downsizing and consolidating as a result of a slow down of module production and the excess capacity of PV manufacturing. It is a sign that the PV market becomes more mature worldwide.

China continues to be the largest producer of PV modules, accounting for more than 60% of annual global production. However China is the sixth-largest market for PV behind Germany, Italy, Japan, Spain and France.

Sources: US Energy Information Administration, International Energy Outlook 2016, chapter 5 “Electricity” ; Observ’ER, le Baromètre 2016 des énergies renouvelables électriques en France ; Observatoire de l’énergie solaire photovoltaïque en France, 21e édition

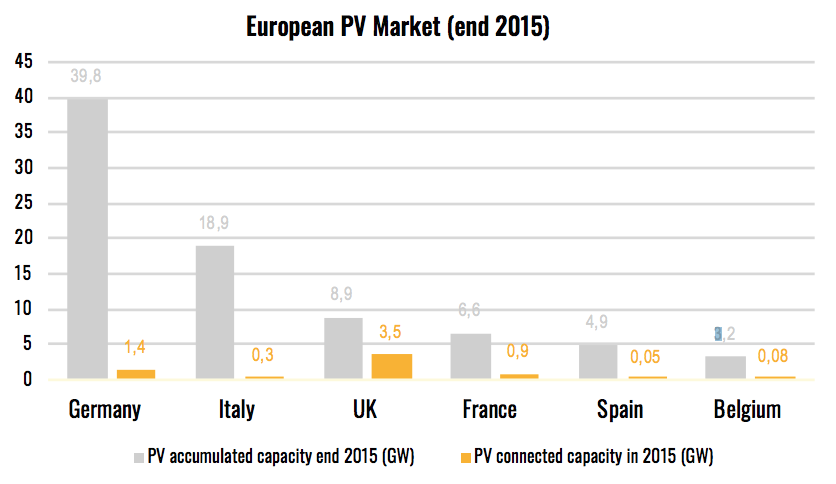

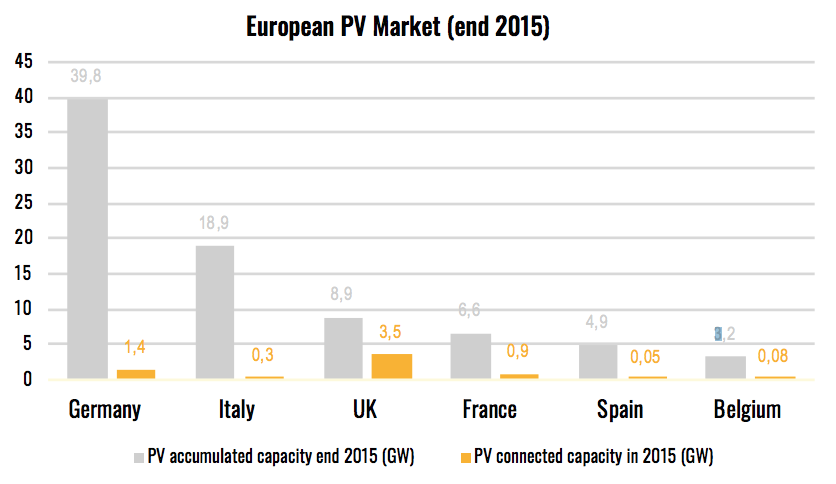

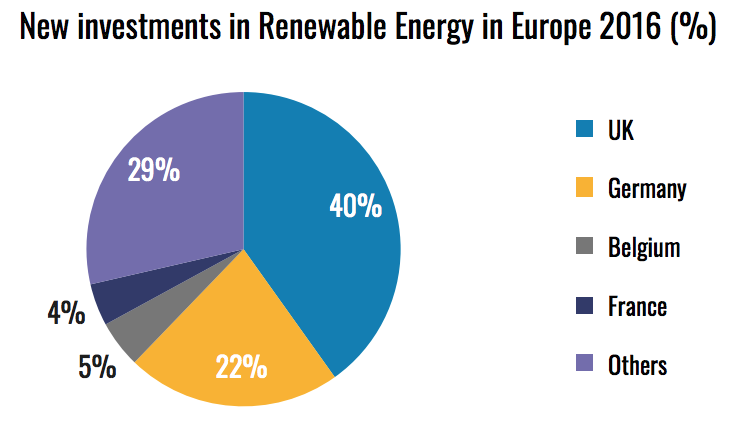

European PV Market

The UK is the most active country (additional 3.5GW). Germany remains the first country when considering the total power (40GW). France hold the 3rd rank in term of connected power in 2015 and is 4th in term of total PV accumulated capacity.

Sources: Observatoire de l’énergie solaire photovoltaïque en France, 21e édition ; Observ‘ER, Le baromètre 2016 des énergies renouvelables électriques en France ; GreenUnivers, le panaorama des Cleantech en France en 2017

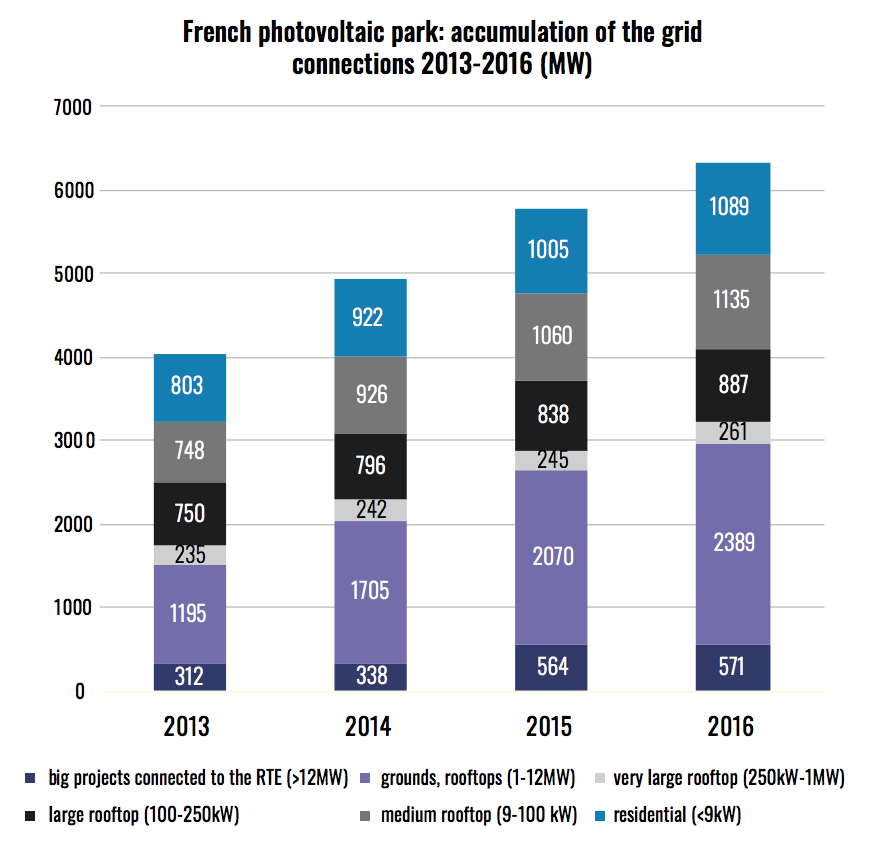

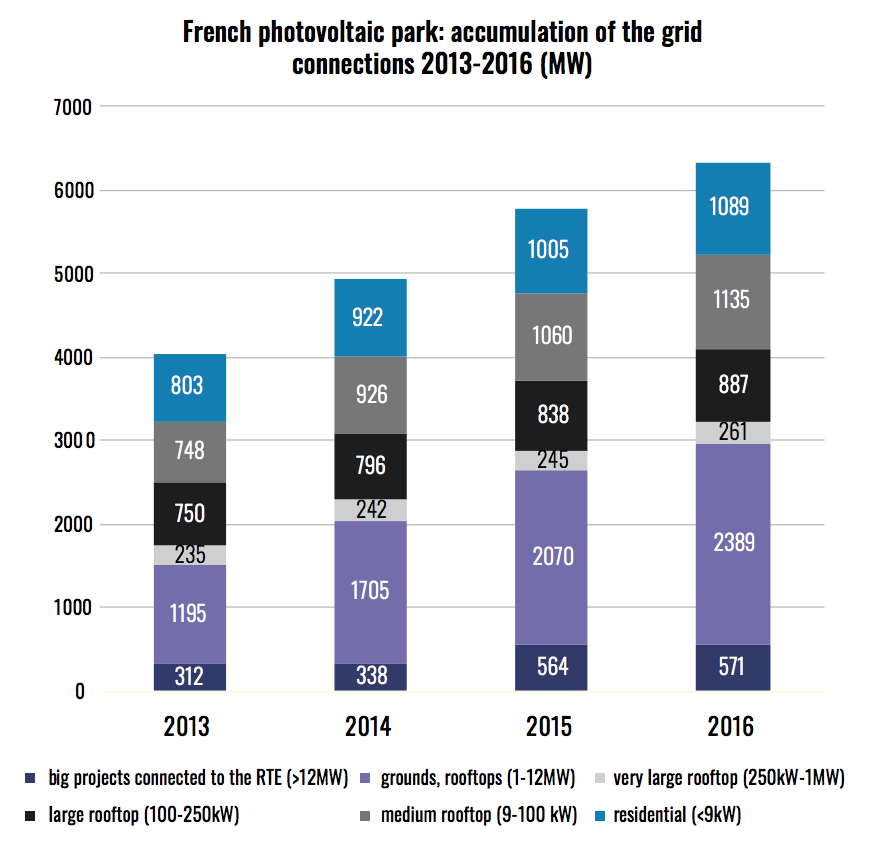

Photovoltaic Solar Energy in France

In 2016, the photovoltaic sector connected 576MW to reach 6 772 MW, that is 5,2% of the installed electric park and 1,6% of the electric production.

Financing and Investments

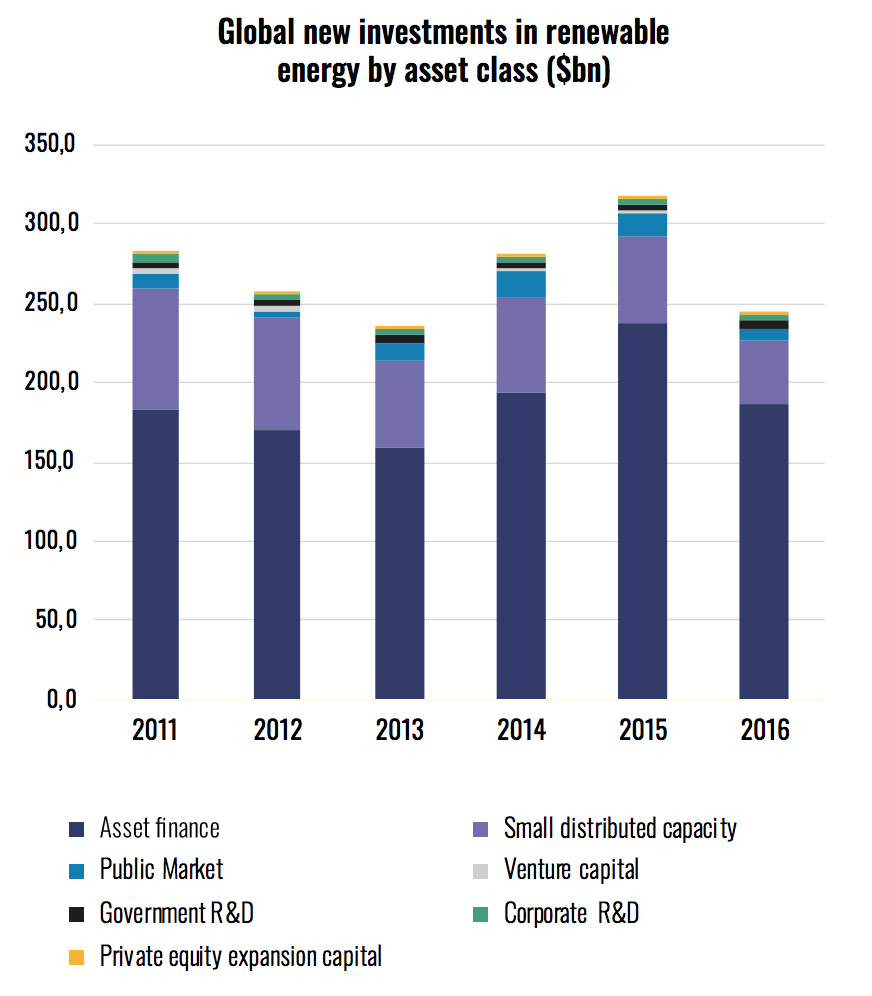

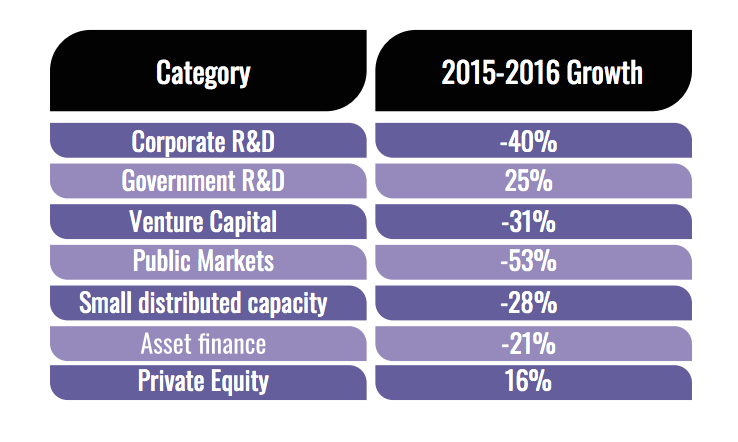

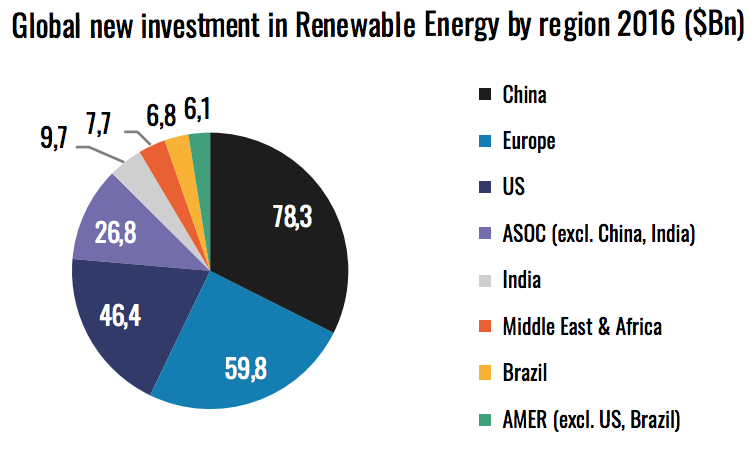

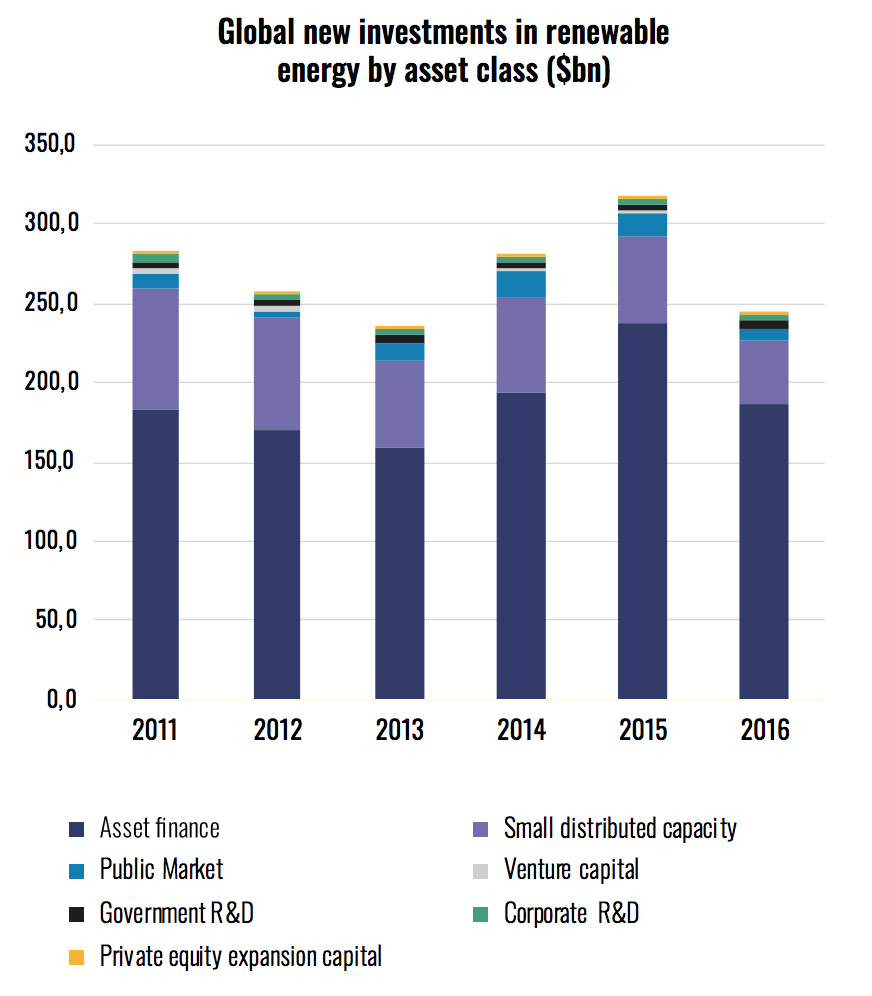

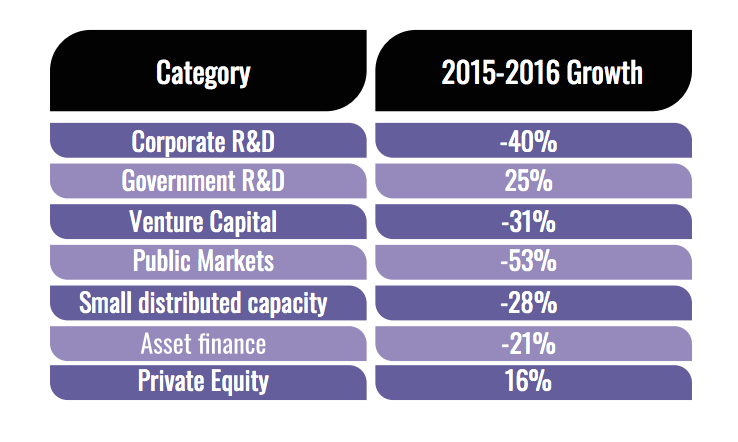

Global Investment Trends in Renewable Energy (exclude large hydro)

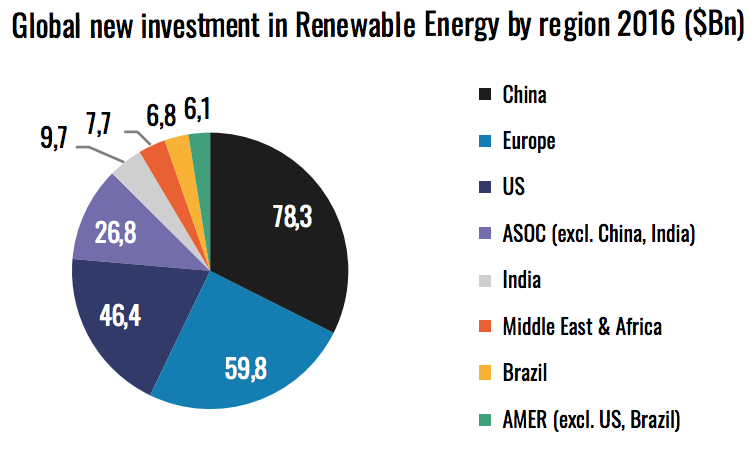

In 2016, investments in renewable energy (excluding large hydro) fell by 23% to $241.6 billion. However, the amount of new capacity installed increased from 127,5GW in 2015 to 138,5GW in 2016.

Reasons for the fall in investment in renewables in 2016

- Lower costs: average dollar capital expenditure per MW down by more than 10% for solar PV, onshore and offshore wind, improving the competitiveness of those technologies.

- Significant slowdown in financings in China, Japan and some emerging markets.

Acquisition Activity

- Availability of finance does not appear to be a bottleneck to investment in renewables in most countries. Investor hunger for mature technologies helped to fuel record acquisition activity in the clean power sector worldwide in 2016, totalling $110.3 billion (up 17%). Purchases of assets such as wind farms and solar parks reached a highest-ever figure of $72,7 billion, while corporate takeovers reached $27,6 billion (up 58%).

Hybrid Projects

Hybrid projects: two different technologies in the same location, to make use of shared land, grid connections and maintenance and to reduce intermittency. Some 5.6GW of these projects have been built or are under development worldwide, including hydro-solar, wind-solar, PV-solar thermal, solar thermal-geothermal and biomass-geothermal.

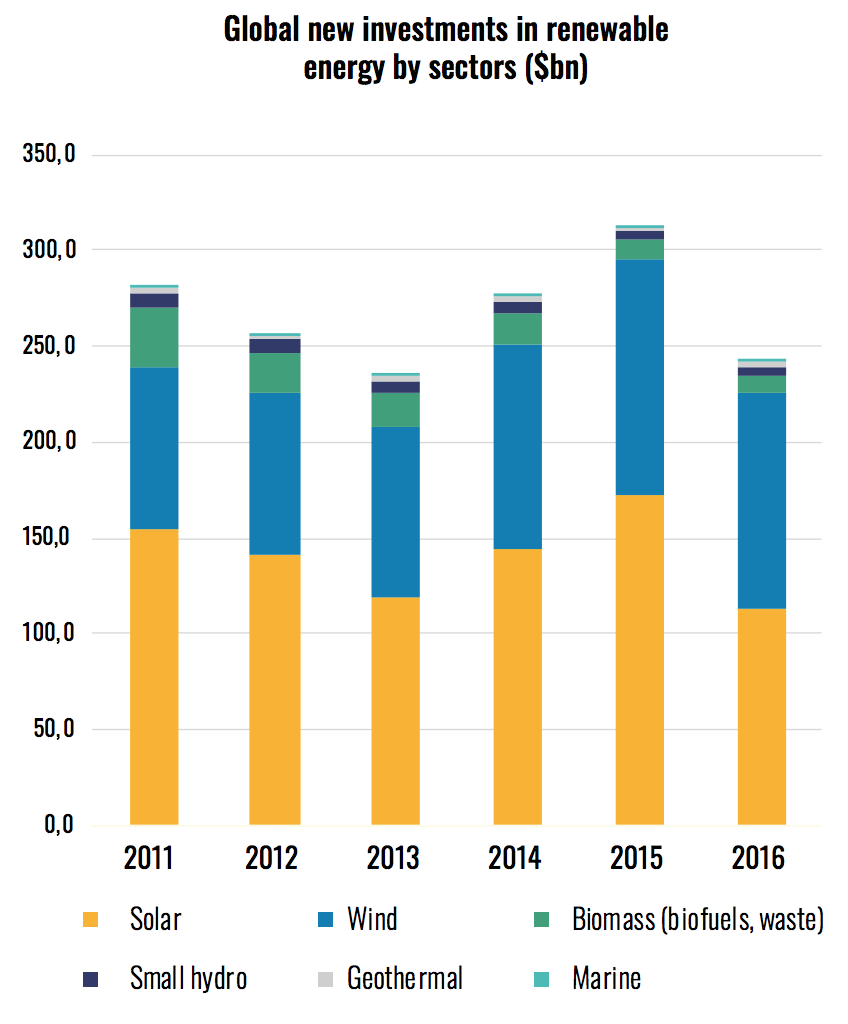

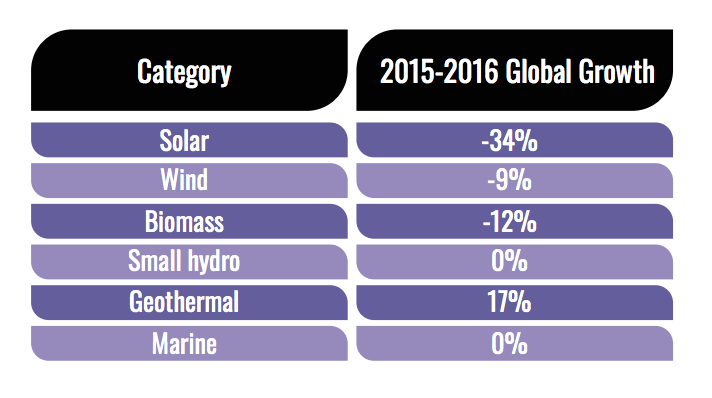

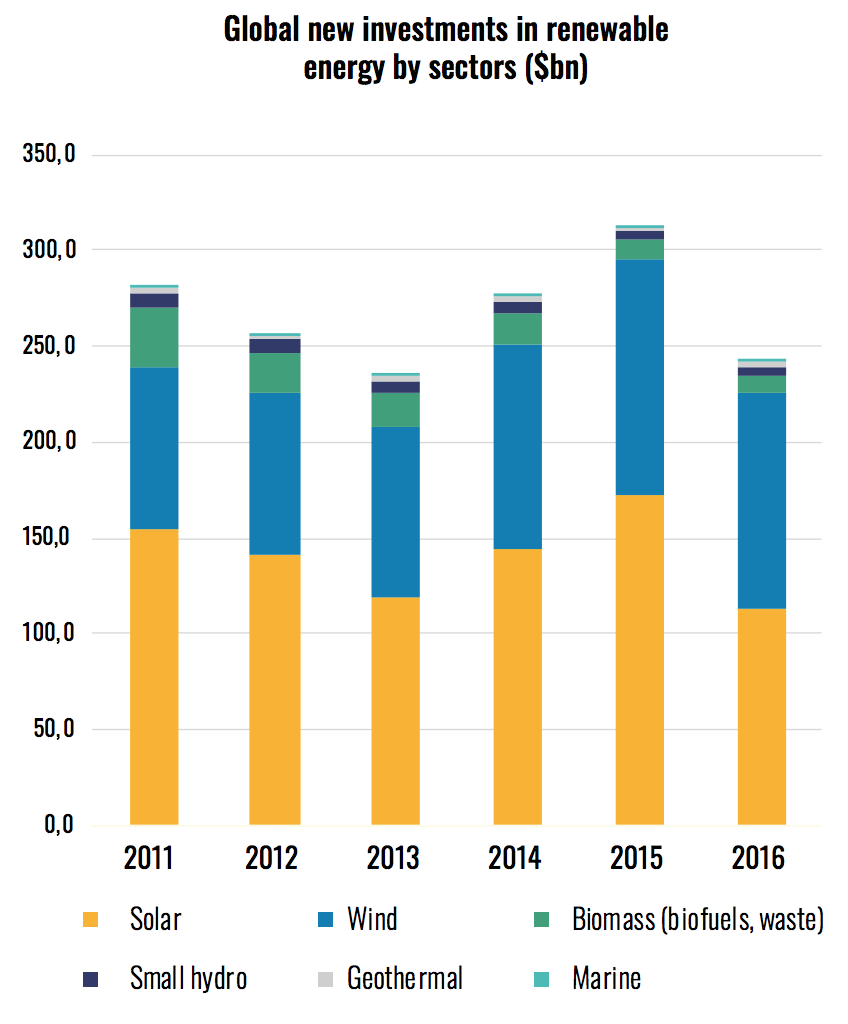

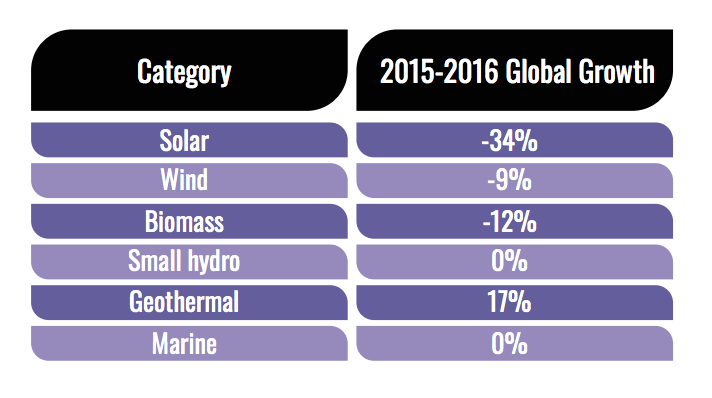

Global Investment Trends in RE by Sectors (exclude large hydro)

Solar

- New investment in solar in 2016 totalled $113,7 billion, down 34% from the all-time high in 2015, due in large part to sharp cost reductions – and to real slowdowns in activity in two of the largest markets (China and Japan).

- Solar capacity additions rose in 2016 to a record of 75 GW, sharply up from 54 GW.

Wind

- Offshore: Europe’s investment record commitments to offshore wind, totalling $25.9 billion, up 53% thanks to final investment decisions on mega-arrays (Hornsea offshore wind project in the UK Nordsea).

- Wind followed closely behind solar, at 112.5 billion globally, down 9% despite the boom in offshore projects.

- Wind capacity additions fell back to 54GW in 2016 from 63GW in 2015.

Other Sectors

- Biofuels fell 37% to $2.2 billion (the lowest for at least 13 years).

- Biomass and waste held steadily at $6.8 billion, and small hydro at $3.5 billion

- Geothermal rallied 17% to $2.7 billion

- Marine edged down 7% to $194 million

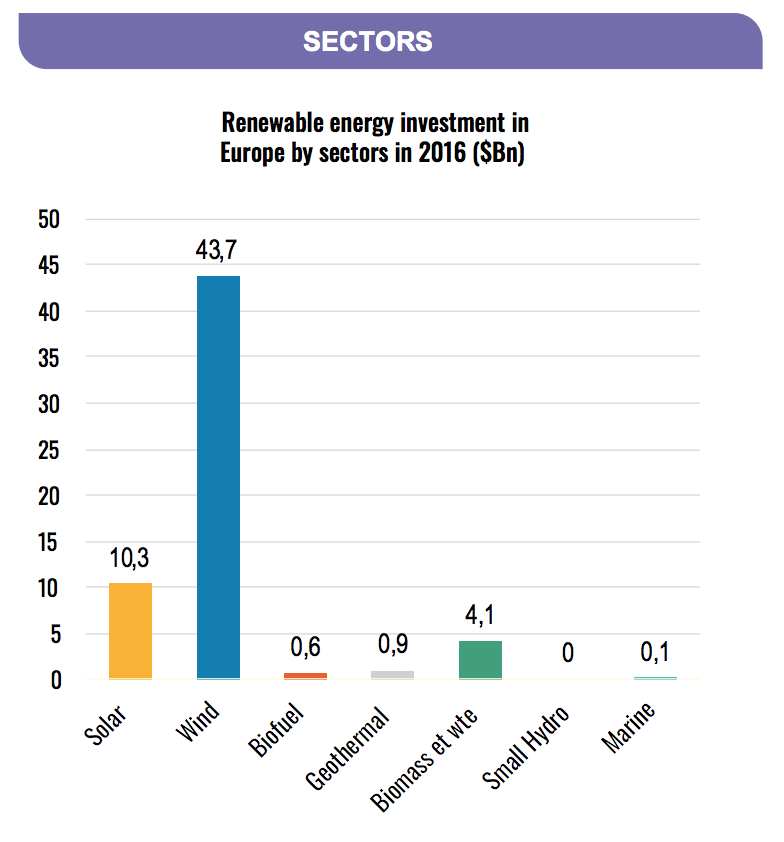

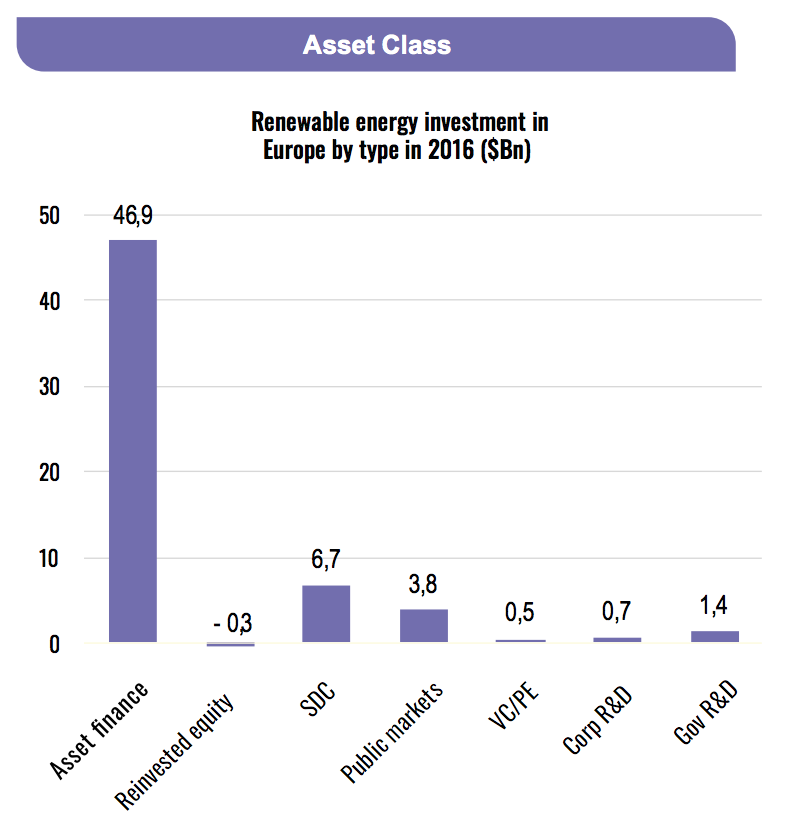

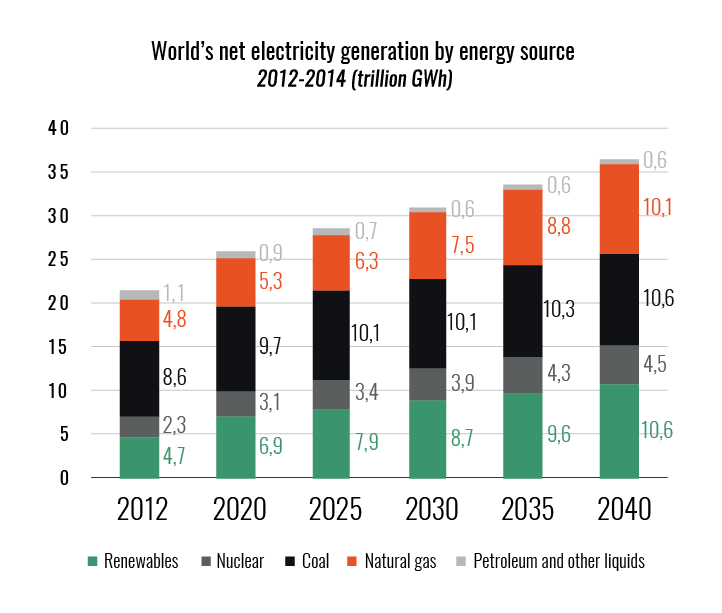

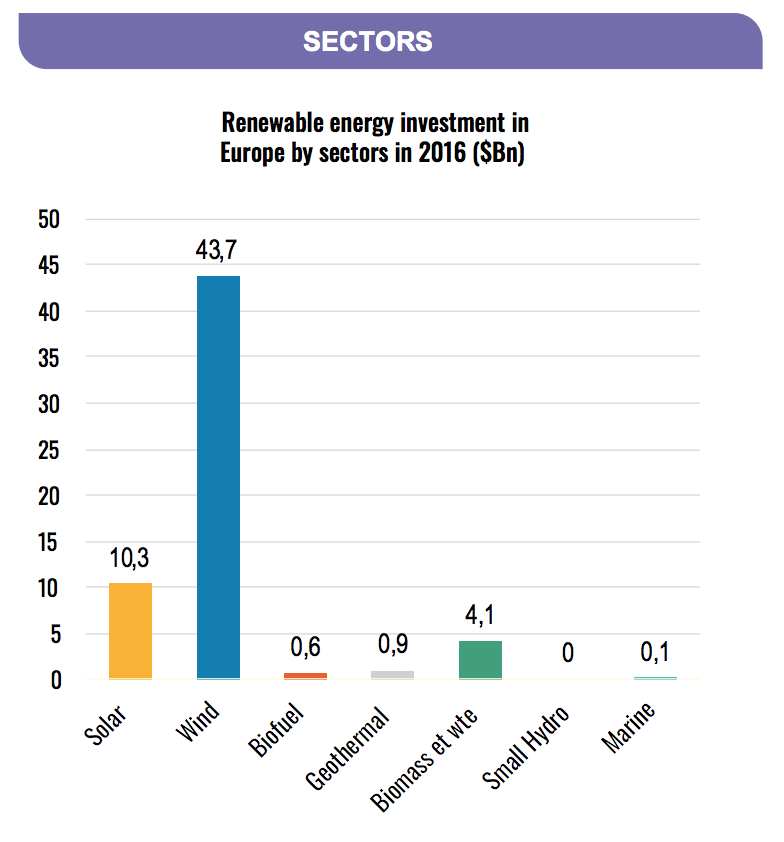

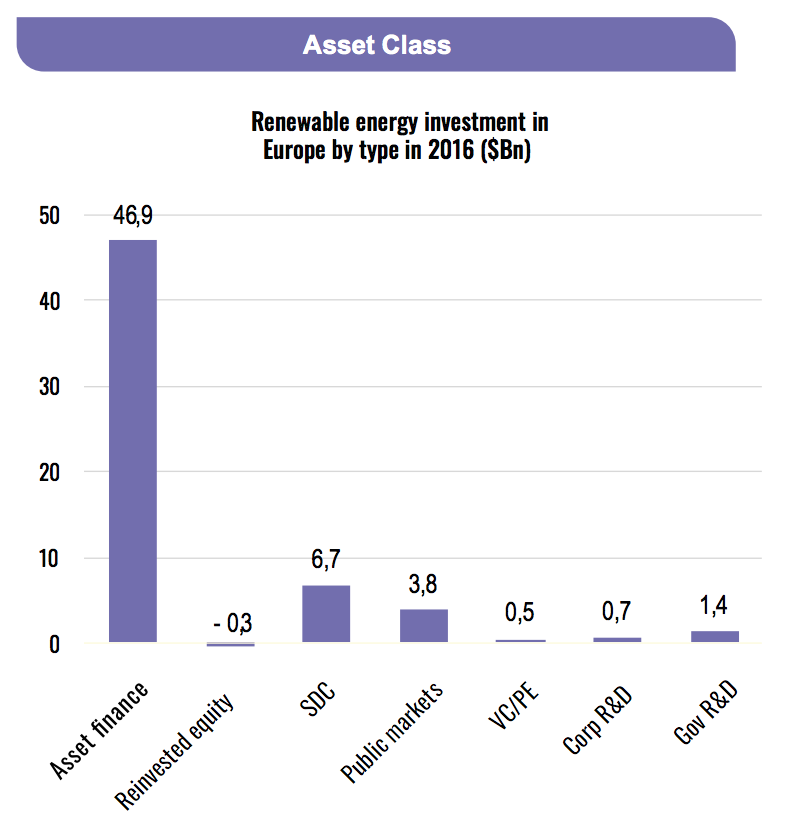

European Investment Trends in RE (exclude large hydro)

Sources: Frankfurt School-UNEP Centre/BNEF, Global Trends In Renewable Energy Investment 2017

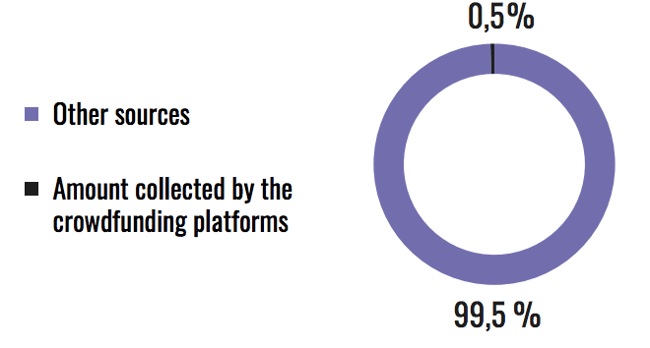

New investments in RE by region 2016 (World, Europe and France)

In 2016, the amount of new investment in renewable energy in France was of $2,6 billions. With a growth of 5% compared to 2015.

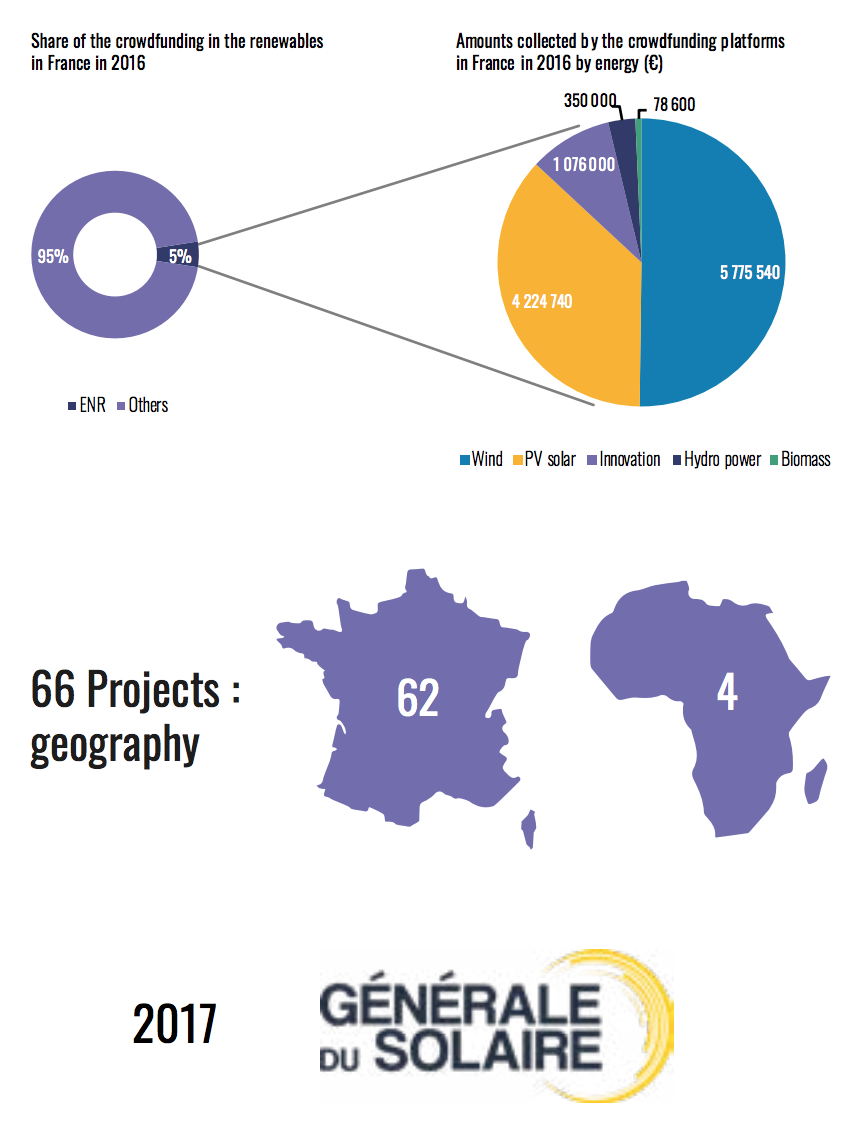

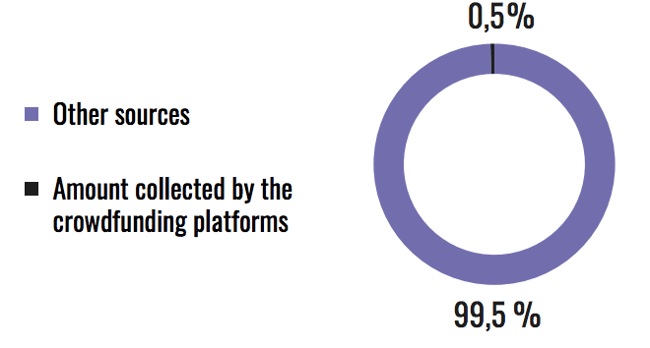

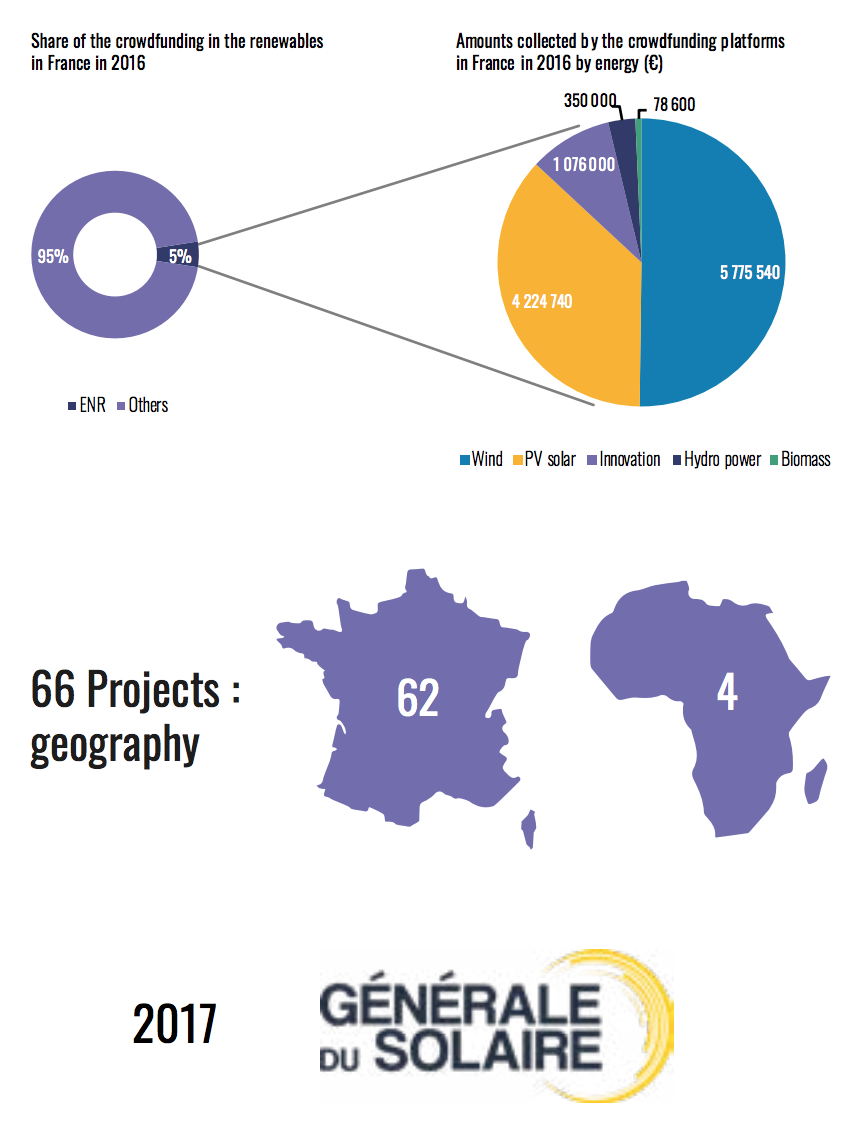

Renewable Crowdfunding in France

The amount collected by the crowdfunding platforms in France in 2016 for the renewable energy is €11,5 millions (= $13,1 millions). The share of the investments in RE collected by the crowdfunding platforms represent only 0,5% of the total of new investment in the RE in France.

However we can hypothesize that 70% of the total amount of investments in RE comes from the banks. By this hypothesis, it occurs that

Sources: Frankfurt School-UNEP Centre/BNEF, Global Trends In Renewable Energy Investment 2017 ; GreenUnivers, “Baromètre 2016 du crowdfunding EnR : les citoyens ont prêté 11,5M€”

Crowdfunding

Crowdfunding in renewable energy in France in 2016

Out of a total of €233,8 millions collected by crowdfunding in France in 2016, €11,5 millions financed 66 renewable energy projects, exclusively in debt.

Sources: GreenUnivers, “Baromètre 2016 du crowdfunding EnR : les citoyens ont prêté 11,5M€”

In 2017, Générale du solaire, a group specialized in developing, engineering-procurement-construction (EPC), financing and operating solar power plants raised €2,5 millions by crowdfunding on the platform Lendosphere to finance its development.

Through this crowdfunding operation, the company wanted to associate the private individuals. 683 lenders mobilized with loans between €50 and €70,000 in addition of two institutional investors (Allianz Crowdlending, Prêtons ensemble).

Solar Energy

- More than half of the projects which were submitted to crowdfunding in 2016 are solar projects, while they represent only 37% of the collected funds.

- Crowdequity should quickly increase in solar energy, stimulated by the bonus granted during calls for tender for the projects including 40% of citizen participation (Law of energy transition).

Wind Energy

- This bonus should also be submitted to wind projects but the global amounts of the projects achieve tens of millions of euros and the law limits the amount raised in debt to 1 M€ by project and 2,5 M€ in capital.

- In 2016, wind energy represents 50% of the borrowed amounts but only 40% of the financed projects.

Innovation, Hydro, Biomass

- The amounts for innovation, biomass and hydro are little representative considering the low number of financed projects (2 innovation projects, 1 biomass project and 1 hydro project).

Advantages

- Test and validation of the concept: Crowdfunding enables a project to be confronted with reality and to see if other people believe in this project.

- A way to reach other forms of funding: A successful crowdfunding campaign can bring a proof of the project reliability to obtain additional financing with others financial sources (like a bank).

- Access to a public: Crowdfunding enables to have access to an important public whose certain members can provide experience and knowledge. In particular for the renewable energy, the local population is more easily involved in the project and can better accept it.

- Tool of commercialization: Equity or lending crowdfunding can be efficient to present the funded project and the organization by directly speaking to the potential customers.

Risks

- Not reached objective: If the objective of fund raising is not reached, the collected money during the campaign is returned to the investors.

- Intellectual property becomes public: The information about the project are online.

- Underestimate of the costs: Possible to not have enough capacities to deal with new investors, to supply updated information about the project or to take care of the shares of the shareholders.

- Reputational damage: Any negligence or error will have a negative incidence on a project or/and company.

Sources: Commission européenne, “Le financement participatif expliqué”

Glossary

Aggregators

Professional intermediary which federates a group of stakeholders looking for buying or selling energy jointly to benefit of a better price.

Asset Finance

All money invested in renewable energy generation projects, whether from internal company balance sheets, from loans, or from equity capital.

CRE

= Commission de régulation de l’énergie The CRE is a French independent legal authority, created on March 24th, 2000. It monitors the smooth functioning of the energy market and arbitrate the differences between the users and the developers.

Feed-in-Tariff

A premium rate paid for electricity fed back into the electricity grid from a designated renewable electricity generation source.

Mergers & Acquisition (M&A)

The value of existing equity and debt purchased by new corporate buyers, in companies developing renewable energy technology or operating renewable power and fuel projects.

Self-consumption

Definition of the 15th February law in France : The self-consumption operation is defined as « le fait pour un producteur, dit autoproducteur, de consommer lui-même tout ou partie de l’électricité produite par son installation » (nouvel article L. 315-1).

Public Markets

All money invested in the equity of specialist publicly quoted companies developing renewable energy technology and clean power generation.

Venture Capital and Private Equity (VC/PE)

All money invested by venture capital and private equity funds in the equity of specialist companies developing renewable energy technology. Investment in companies setting up generating capacity through special purpose vehicles is counted in the asset finance figure.

Linky

Linky is the name of the smart meter developed by Enedis (formerly ERDF), main administrator of the electricity network of distribution in France, in application of the European directives recommending the generalisation of this type of meters.

RTE

= Réseau de Transport d’Électricité It is the electricity transmission system operator of France.

FPCI

Fonds Professionnel de Capital Investissement FCPI is a French type of funds dedicated to investments in innovation. To qualify for favourable treatment, at least 60% of the assets of the FCPI must be invested in innovative companies established in the EU and subject to local corporate income tax.

FIDEME

FIDEME = Fonds d’investissement de l’environnement et de la maitrise de l’énergie. Cf. slide 45 Mirova’s three renewable energy infrastructure funds.

.png)